Squid price rises - 翻译中...

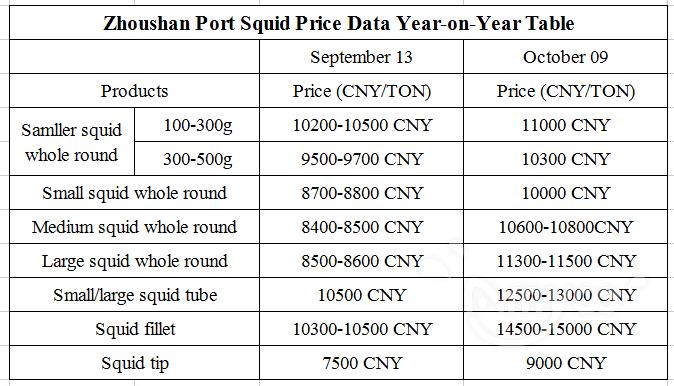

With the coming of the peak season for traditional squid processing and sales in the second half of the year, the market demand is strong. Since mid-September, the price of Gigas squid at Zhoushan Port has been rising all the way. Especially after the National Day, the price of medium and large squid has jumped. The average price increase has reached 500-600 CNY/ TON in just a few days, and there is a further upward trend, which has led to a new round of overall rise in the price of Gigas squid, and the bullish market has strengthened in the second half of the year.

According to the analysis of senior people in the squid industry in Zhoushan City, September and October each year are important window phase for squid processing and sales. It is also the weather vane and important watershed for the fluctuation of squid prices in the second half of the year. The active market situation is driven by positive factors, supported by the expected reduction in the supply of squid raw materials, and the bullish speculation of traders, as well as the increase in the cost of ocean fishing. To sum up, there are mainly these several reasons.

According to the analysis of senior people in the squid industry in Zhoushan City, September and October each year are important window phase for squid processing and sales. It is also the weather vane and important watershed for the fluctuation of squid prices in the second half of the year. The active market situation is driven by positive factors, supported by the expected reduction in the supply of squid raw materials, and the bullish speculation of traders, as well as the increase in the cost of ocean fishing. To sum up, there are mainly these several reasons.

1.The improvement of squid sales

With the loosening of foreign epidemic control, the demand for squid products has rebounded and increased. This year, foreign export orders have unabated. Some large squid processing factories are producing at full capacity. Gigas squid is the main raw material for processing aquatic products, and the supply and demand are both booming.

At the same time, due to the impact of the domestic epidemic, the import volume of other foreign aquatic products this year has decreased significantly compared with previous years, as well as the ten-year fishing moratorium and severe drought in the Yangtze River, the decreased output of freshwater products, causing the price of many domestic aquatic products to rise. Due to high producing and other unfavorable reasons, the price of Gigas squid has not risen but fallen, and has been at a low price level in recent years, with outstanding cost performance. Significant market results have been achieved, forming a double-cycle virtuous drive for the international and domestic large markets. Most of the Gigas squid raw materials accumulated last year have been digested.

2. The sluggish production of squid and the high fishing cost.

Since May of this year, fishing in the high seas in the northern part of the southeastern Pacific Ocean has not been ideal, and the production situation is significantly worse than expected. The average daily output is only 2-3 tons. In addition, the oil price has skyrocketed due to the Russian-Ukrainian war, and the comprehensive cost of ocean squid fishing has risen sharply. At present, the average direct fishing cost per ton of fish is close to 10,000 CNY, while some large-tonnage fishing boats exceed 12,000 CNY. The fishing production has suffered losses to varying degrees. Many operators generally have a strong inherent desire to increase the price of squid.

3. The market for the supply of squid raw materials is expected to decrease in the second half of the year.

In addition to the sluggish production of self-caught Gigas squid in the ocean, this year's squid fishing in Peru's 200-nautical-mile exclusive economic zone has seen low yields, local production is limited, and the catches are mainly exported to Spain and Japan. The cold chain at the port is restricted, and the import volume of Peruvian squid products this year is also significantly lower than in previous years.

At the same time, due to the low squid price and big production losses, a large number of Indian Ocean light-netting fishing boats stopped production and docked in the first half of the year. The output of Indian Ocean squid, which is the main alternative raw material for Peruvian squid processing, has been greatly reduced, and the existing fish stocks are very few. In addition, in the second half of this year, China implemented a three-month independent fishing moratorium from July 1 to September 30 in the high seas of the northern Indian Ocean for the first time. The fishing season was postponed, and the competitiveness of alternative raw materials was correspondingly reduced.

At present, the fishing season for giant squid has not yet come, and the fishing of Indian Ocean squid has just begun. Although the production situation remains to be seen, in view of the poor production situation of squid in the past few months, the director of domestic ocean fisheries is focusing has restricted the operating scope of squid fishing boats in the high seas of the southeastern Pacific Ocean. Many industry insiders are generally not optimistic about the follow-up fishing. In the second half of the year, some predict the supply of squid processing raw materials will be less than the demand.

4. The increasing price of Gigas squid head, fillet and tail.

With the reduction of cooked products imported from Peru, since May this year, Giant squid fillets, which are mainly used for the processing of leisure cooked products, have been in short supply, and the price has been rising from the lowest 7000 CNT/TON to the current 14,500-15,000 CNY/TON. To reduce the processing cost, some plants can only replace the Giant squid fillets with medium and large fillet, and the corresponding raw material market awareness increases, some traders grasp this chance to push the price, also effectively leverage the medium and large Gigas squid prices jumped, and generate price spillover effect, promote the small size of Gigas squid, smaller squid prices rise together.

Squid prices in the face of a new round of soaring hot market, a few happy a few sorrow, all parties have joy and worry. It is understood that many fishing industry believes that squid prices from the trough to return to the fundamentals. It is sudden, but also as expected. It is claimed that according to the existing squid fishing actual production costs and historical price reference squid, and from this year other aquatic product prices are rising macro background consideration, The original article Peru squid average price of ten thousand yuan per ton price range is reasonable, market all parties should be able to accept, and continue to look good and looking forward to the next the space of the squid prices could rise further, while some squid processing enterprises expressed worried, think the squid prices plunged easily discourage the market parties, is not conducive to the expansion of processing capacity, It will take some time to adjust to this round of higher squid prices.